Calculate Present Value Continually Compounding Discount Rate

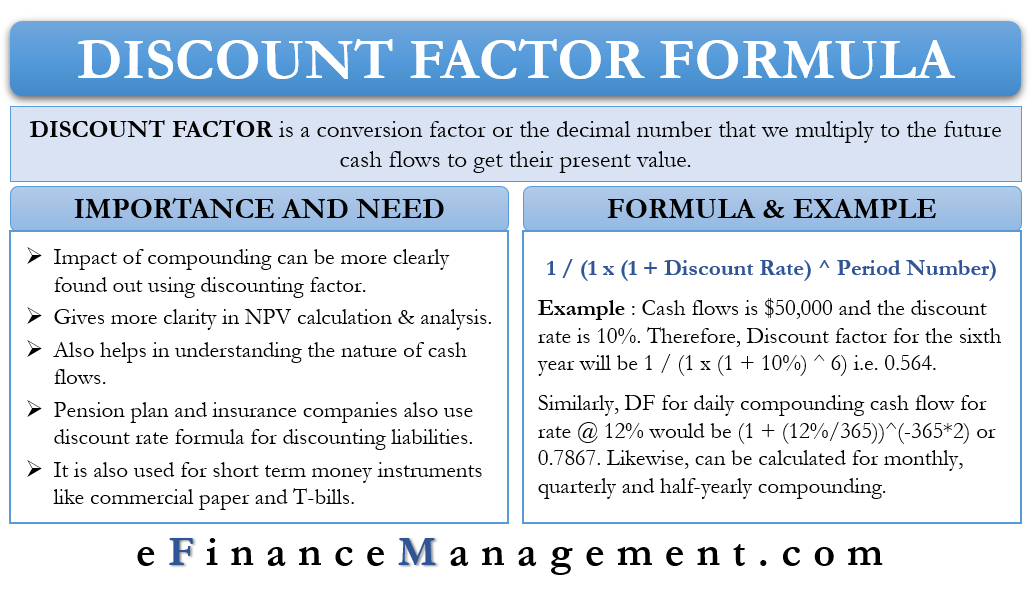

In the financial world time value of money is one of the essential criteria to ascertain and decide the projects or investments. The discount rate is the return a project needs to earn to be acceptable. On the other hand, a discount factor is a factor or the decimal number that we multiply by the future cash flows to get their present value. The discount factor formula includes the discount rate.

In simple words, we can say that the discount factor is a conversion factor when calculating the time value of money. We mostly use this factor when doing valuation using the DCF (Discounted Cash Flow) technique or calculating NPV (net present value).

Importance and Need of Discount Factor Formula

There are formulas or functions (in excel) to calculate the present value of the cash flows. These formulas do not separately require the calculation of the discount factor. Yet many analysts prefer to use the discount factor formula to get its values.

It is because they want to see the impact of compounding more clearly for each period. Further, the analyst uses discount factors if they want more clarity in the NPV when carrying financial modeling in Excel. Also, using the discount factor formula makes it easier to verify the DCF results.

The discount factor decreases as the number of years increases because of the effect of compounding that builds over time. Such a concept of discount factor helps a great deal in understanding the nature of cash flows. So, the more extended the period of cash flow, the lower will be the discount factor.

In excel, the discount factor is a substitute for the XNPV or XIRR functions. We can quickly and manually calculate the present values if we have the discount factor values.

The use of the discount factor also makes modeling more accurate. With a discount factor, one could specify the number of days in a period for which one wants the results. For example, if an analyst wants to consider the impact for only 85 days, then they can do so.

Apart from analysts, the pension plan and insurance companies also use the discount rate formula for discounting liabilities. Further, the discount factor is also of use for short-term money market instruments, such as commercial paper and T-bills.

Discount Factor Formula

Following is the discount factor formula – 1 / (1 x (1 + Discount Rate) ^ Period Number)

To get the discount factor, you need the following things:

- Discount rate

- You must know the tenure of the investment (t) or how long you plan to invest.

- You also need to know the number of compounding periods per year (n). It can be quarterly, half-yearly, yearly, etc.

In case of discrete compounding, the discount factor formula is (1 + (i/n) )^(-n*t).

In the formula, i is the Discount rate, t is the number of years, and n is the number of compounding periods in a year.

For continuous compounding, the formula is Discount Factor= e-i*t

Examples

Let us understand the calculation with the help of examples:

- Suppose constant cash flows for a company is $50,000 and the discount rate is 10%. Now, if we want to calculate the discount factor for the sixth year, it will be 1 / (1 x (1 + 10%) ^ 6) or 0.564. The NPV, or the net present value will be $50,000*0.564 = $28,200.

- Calculate DF if there is continuous compounding, while the discount rate is 12%, and t is two years? The discount factor would be e^(-12%*2) or 0.7866.

- If there is daily compounding with the same discount rate and t (as above), then calculate DF? The n will be 365 days. Here, we will use the formula of discrete compounding. So, DF will be (1 + (12%/365))^(-365*2) or 0.7867.

- In the case of monthly compounding, n will be 12. The DF will be (1 +(12%/12))^(-12*2) or 0.7876.

- For quarterly compounding, n will be 4. The DF in this case will be (1 + (12%/4))^(-4*2) or 0.7894.

- For half-yearly compounding, n will be 2. The DF in this case will be (1 + (12%/2))^(-2*2) or 7921.

- Discount Factor Formula | Calculator (Excel template) [Source]

- Discount Factor Table [Source]

- How to Calculate the Discount Factor for a Company [Source]

Source: https://efinancemanagement.com/investment-decisions/discount-factor-formula

0 Response to "Calculate Present Value Continually Compounding Discount Rate"

Post a Comment